Ideas, strategies and tactics

The Strategy Guy's Blog

PORTFOLIO STRATEGY

What's Your Portfolio Strategy?

This week, a new strategy client asked for some clarity around their product strategy and where their marketing and sales efforts should go at the moment, given their reduced COVID-19 cash flow.

We drafted up a 2 x 3 on the whiteboard, and we mapped out a growth-share matrix. Why not create your growth-share matrix to come up with a portfolio strategy?

Step 1. On a 2 x 3 matrix, plot each of your product/service offerings by the likely market share you can achieve and the expected growth in that market space.

Step 2. Calculate an Expected Return for each offering by multiplying the potential profit level by the % chance of success. The larger the Expected Return, the larger the circle you should draw for each product.

Step 3. Now step back and assess which offerings should take priority and label them 1,2,3,4,5,6 etc. Large circles are good to prioritise, especially those in high growth markets or/and markets where gaining a dominant market share advantage is...

AGEING POPULATIONS

Maturity comes with age.

Mature people have learnt not to take their life so seriously. Paradoxically, however, people who didn't take their health seriously and create some wealth when they were young may experience fewer options and have fewer years to enjoy before they die. Ageing Populations are one of the six mega-trends I share with my conference audiences.

These mega-trends are:

- Global Warming

- Water Scarcity

- Ageing Populations

- Increasing Urbanisation

- the Rising Middle Class

- AI and Automation

Mega-trends are things that are not going to change any time soon. Mega-trends are things we can bank on, and it makes sense to formulate our strategy with mega-trends in mind.

In this blog, I have included an interview with an expert on Ageing and Finance who shares some pearls of wisdom around ageing and strategies for living a happy and fulfilling life. https://youtu.be/0pYDKEvQY6s

GLOBAL WARMING

When we think about the future, there is always a mixture of certainty and uncertainly around the corner. Generally speaking, the future is always inconvenient!

If things were certain, then strategy would be easy. Right?

I like to call things that are certain 'mega-trends, and I often share six of them with my audiences. They are:

- Global Warming

- Water Scarcity

- Ageing Populations

- Increasing Urbanisation

- The Rising Middle Class

- AI and Automation

These are six huge trends that are not going to change any time soon. Mega-trends are things we can bank on, and it makes a lot of sense to formulate our strategy with mega-trends in mind.

Below is a link to a 30 min YouTube interview I recorded with an expert on Global Warming to give us an update and the best approaches for dealing with Climate Change. https://youtu.be/LKWDSz5Caw4

STRATEGIC READING

From my visits to second-hand book shops, I have discovered that people who write inside their books finish reading them.

Less than half the people who buy a book finish it. And less than a third finish e-books.

When writing The Strategy Book, I designed it to be a deliberate blend of strategy notes and blank pages that would capture a reader's ideas, insights and goals. Most books are one-way monologues. The Strategy Book is a two-way dialogue.

Do you ever read the same book twice?

Heraclitus said, "No one steps into the same river twice."

The next time one steps into a river, it is not the same river, and they are not the same person. Rivers flow, and people grow.

I re-read my favourite books.

Why?

The same text can foster shifting and added perspectives over a lifetime. When I re-read a great book, I am a different person. I experience the book differently, and I capture and create new value.

What book are you reading right now?

Which books would you like to re-read?

I am re-reading 'A Wor...

THE MIDDLE

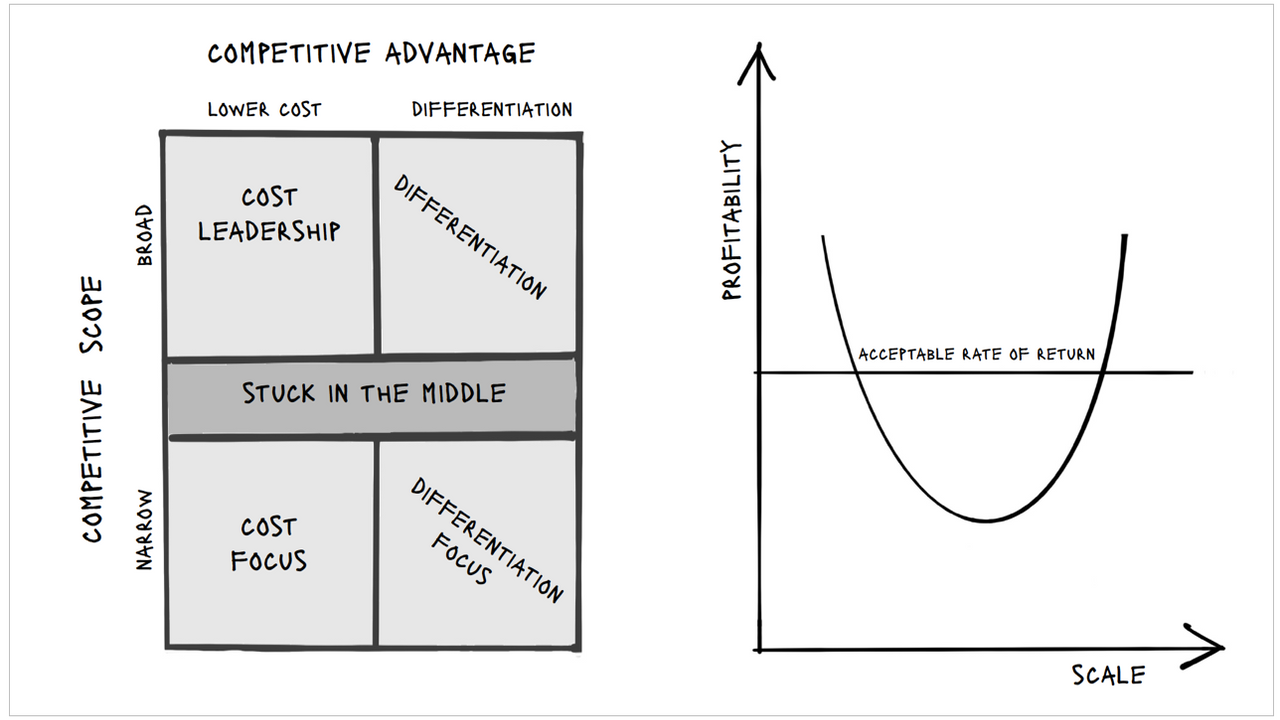

Investors Warren Buffet and Charle Munger like to invest in firms that are low-cost producers. These firms often aim to be The Cost Leader in their field. Becoming The Cost Leader results in high levels of operational efficiency. However, operational efficiency is not a strategy. Every business should aim to be operationally efficient.

Indeed, most companies have 'money lying around on the ground' waiting to be collected once processes and operations can reduce cost and create more value. Operational efficiency should be a goal for all companies, whether they choose to compete uniquely using a Cost Leadership, Differentiation or Focus approach.

When it comes to your strategic approach, it is essential not to get 'stuck in the middle.' Firms that Focus on a particular segment or Differentiate from the pack will often scale well, to a point. However, achieving massive scale is often challenging (but not impossible) without ultimately becoming a Cost Leader in some way. Firms with com...

STRATEGIC ACCOUNTANT

What is a Strategic Accountant?

I am looking forward speaking at the CA ANZ 2021 Accounting Conference this month.

I will share that Strategic Accountants make it their business to understand their client’s business. These accounting paragons focus a client's attention, energy, and investment in three ways to help them analyse the past, manage the present and lead the future.

My presentation will assist accountants to reimagine their firm, its services and their career path. Notably, I will discuss the impact of inertia, entropy and bias. I will reveal why accountants should learn to juggle and ensure their clients do the same.

PICTURE STRATEGY

After three months of researching and writing The Strategic Accountant, the book is nearly finished :-)

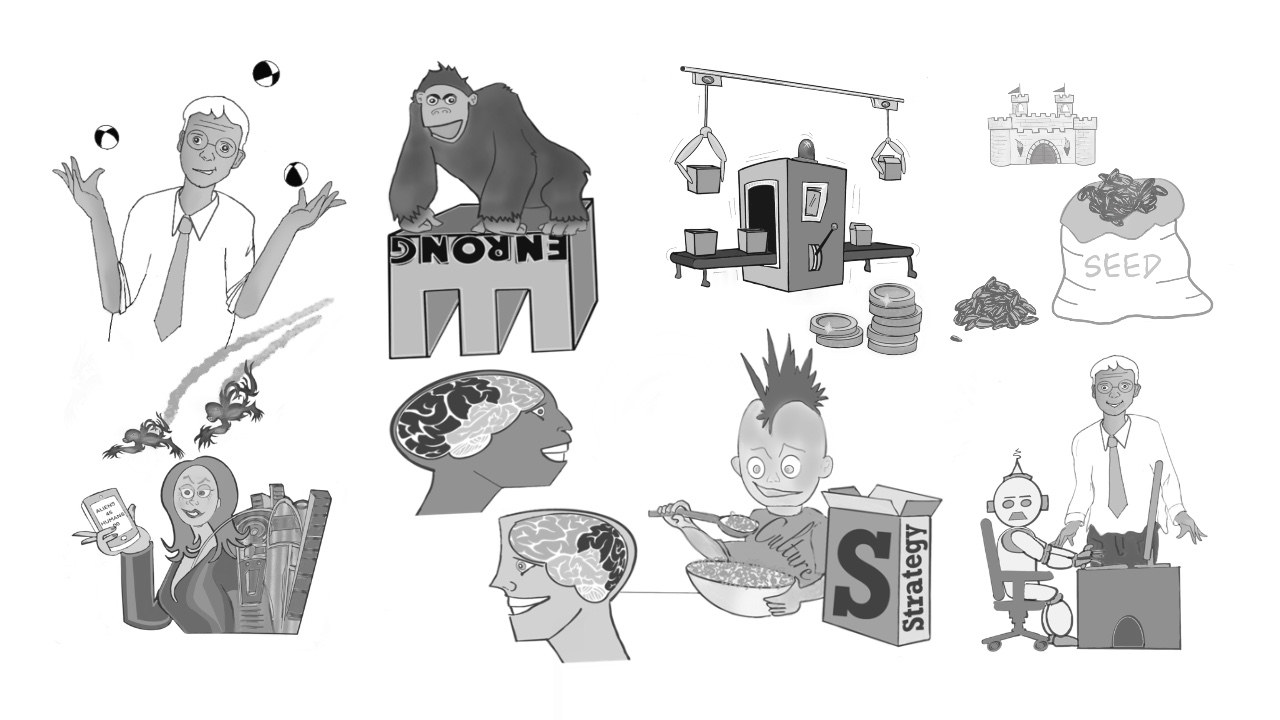

This week I finished my early drafts of eight chapter illustrations for the book.

Each 'picture tells a story' about how to become a Strategic Accountant.

1. Why accountants should learn to juggle.

2. Remember Enron and meet the 'gorilla that is still in the room'.

3. Find money 'on the ground' in any business.

4. Sow your seeds wisely and inherit the Kingdom.

5. Strategy offers us learning loops, if we are prepared to 'Live.Die.Repeat'.

6. Why you might like part of a Neanderthal Brain in your head.

7. 'Culture Eats Strategy for Breakfast'.

8. Future-proof your accounting firm with AI and 'bots'.

A special thanks to my wonderful reviewers: Bryan Worn, Dale Edwards, Natasha Milne, Natalie Kidcaff, James Carlopio, Oscar Hauptman, Dolores Cummins, Brad Reece and Tom Smith.

JUGGLING FASTER

The positive market response to Apple's new Silicon computers highlights the power of parallel processing. Apple achieved this with a reduced instruction set computer (RISC) design. RISC microprocessors are not new. In the late 1980s, as a Systems Engineer at Hewlett Packard, I compiled and executed code on a quarter-of-a-million-dollar Unix workstation that housed the world's first and fastest parallel reduced instruction set microprocessor (PRISM). Apple's M1 microprocessor is 10,000x faster than the first PRISM microprocessor and sells for just eight hundred dollars!

RISC computing breaks down complex software instructions into smaller parts that run in parallel on microprocessor arrays so that software programs compile and execute much faster. While computers can handle multiple tasks simultaneously, by comparison, humans are poor at multitasking.

The pandemic highlighted human multitasking limitations to me. Once CEOs became distracted with managing the moment-to-moment issues o...

TACKLING ELEPHANTS

Like a chess player, every business owner makes a series of moves. If the number of winning moves outweighs the losing ones, the business may survive. When the number of winning moves significantly outstrips losing moves, the business thrives. Waiting is considered a move when it is done consciously.

Every business experiences inertia, entropy and bias. When these three take a hold, businesses ‘fall asleep at the wheel.’ Once asleep, companies believe they can’t predict the future and have little hope of changing it. This sort of thinking is ‘the elephant in the room’ and reduces competitiveness and profitability.

The best approach to the elephant in the room is to create the future. My most successful clients regularly commit to four high-level days over six to eight weeks.

DAY 1 - UNDERSTANDING

Once the right people are in the room and in the right seats, I facilitate conversations that deliver a clear and dispassionate view of the industry and it's future value chain. We revisi...

ZEN AND STRATEGY

There is a Zen saying... “The Great Way is not difficult for those who have no preferences.” In Zen, the true nature of things or Tao can be found in moments of choiceness awareness. To deny the truth of things is to miss reality. If we allow our personal preferences to impact our choices, our choices will be grounded in personhood rather than reality.

The Jesuits and many others understand personhood this way. “Give me a child until they are seven years of age and I will show you the adult.” EEG scanners reveal that in the first years of life our brain frequencies are much slower and we spend a great deal of time under the influence of Theta waves. Theta waves are pre-conscious in nature, which means as little children we are highly impressionable and programmable. These preferences and conditions in our holding environment, before the age of seven, are systematically laid down in our personality.

Our personality based choices are spontaneous, unconscious and automatic. Many of us...